Amid the Mideast war, Ukraine military stalemate with Russia, and rising tensions with China over Taiwan, it’s important to remember that the modern era has been in crisis almost perpetually, and the U.S. stock market has continued to rise anyway.

People tend to assume what’s happening in the world now is going to continue and this can result in making bad investment decisions. Behavioral economics even has a name for this human foible: recency bias. So here are key facts to remember in this time of geopolitical turbulence.

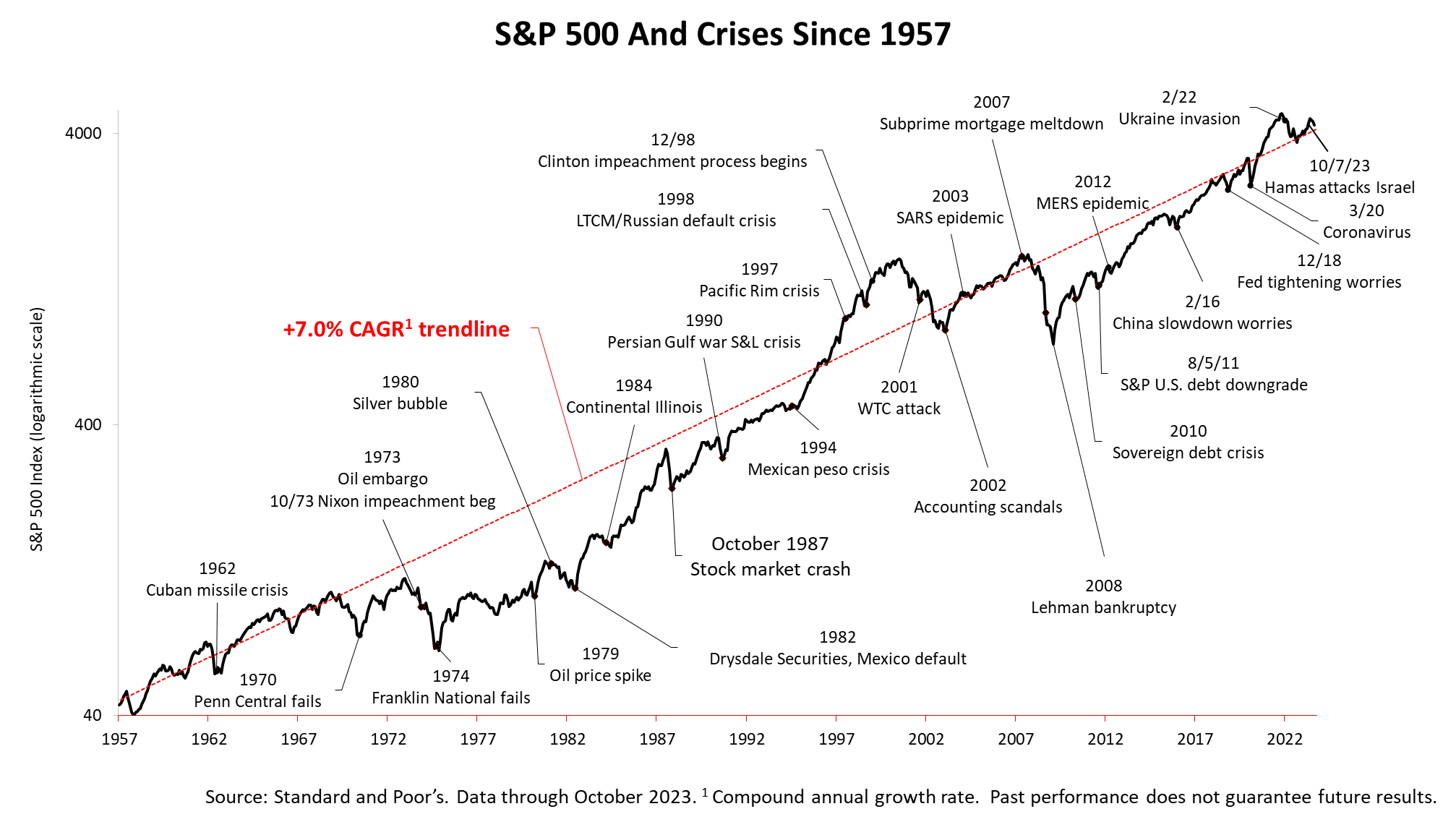

The Standard & Poor’s 500 stock index since 1957 has grown at a compounded annual rate of 7%. And that’s without reinvesting dividends earned on stocks, which would boost the average annual growth rate to about 10.5% annually.

This chart could easily contain many more crises, such as the November 1963 assassination of President John F. Kennedy, the fall of Saigon in April 1975, the Brexit referendum in June 2016, and the bursting of the tech bubble in 2000. But you get the idea from this collection of crises.

Things could be different this time, which is why securities regulators insist on mentioning that past performance is not a guarantee of future investment results. However, it’s also important to remember amid current geopolitical crises that bad events came and went in recent decades, but the Standard & Poor’s 500 stock index, a benchmark of American progress, kept appreciating anyway.