With Russia in an existential economic war with most of the world, it’s a good time to mention a problem with the financial news media.

The media create a mystique of infallibility of people they anoint as experts. It is only polite for a financial reporter on TV to treat an expert with respect on live TV, which gets replayed on TV and the internet. However, even though reporters may have the best of intentions, in giving great financial minds the respect they are due for their track record in the past, the financial media inadvertently portray sources as gurus without giving you everything you need to know to invest wisely.

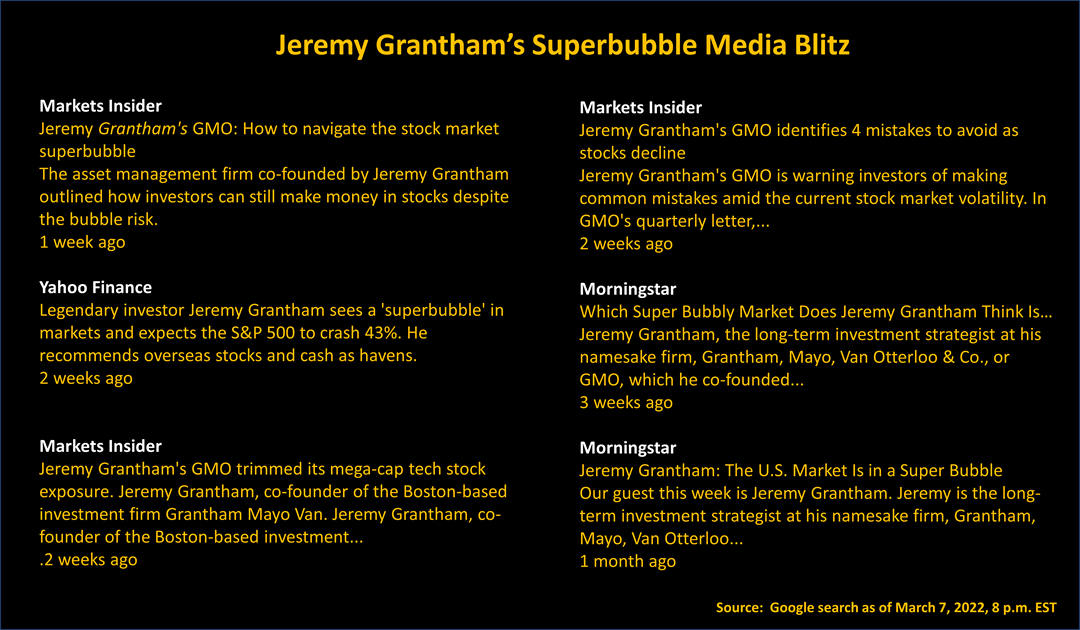

For example, Jeremy Grantham, a great investor who built a company managing more than $100 billion, has been interviewed on financial TV often recently saying the U.S. stock market is in a “superbubble.”

Mr. Grantham is hugely successful and has made prescient investing calls in the past, investing in timber forests early before they soared in value, for example. But can you trust the advice of gurus?

The red line in this chart highlights the valuation placed on the Standard & Poor’s 500 stock index in the last stock market bubble of 1999 and early 2000, and the small red line on the upper right highlights the valuation of the S&P 500 as of March 4. 2022.

Jeremy Grantham is a guru on investing, but stock values are not out of line with the long-term trend line of 10% annualized return over the long run dating back to 1871. The 10% trendline comes from another Jeremy, Prof. Jeremy Siegel, author of a seminal book about investing, “Stocks for the Long Run.”

You do not need to be a guru to be a financial advice professional, but you do need to be able to see the trouble with financial news in today’s world.