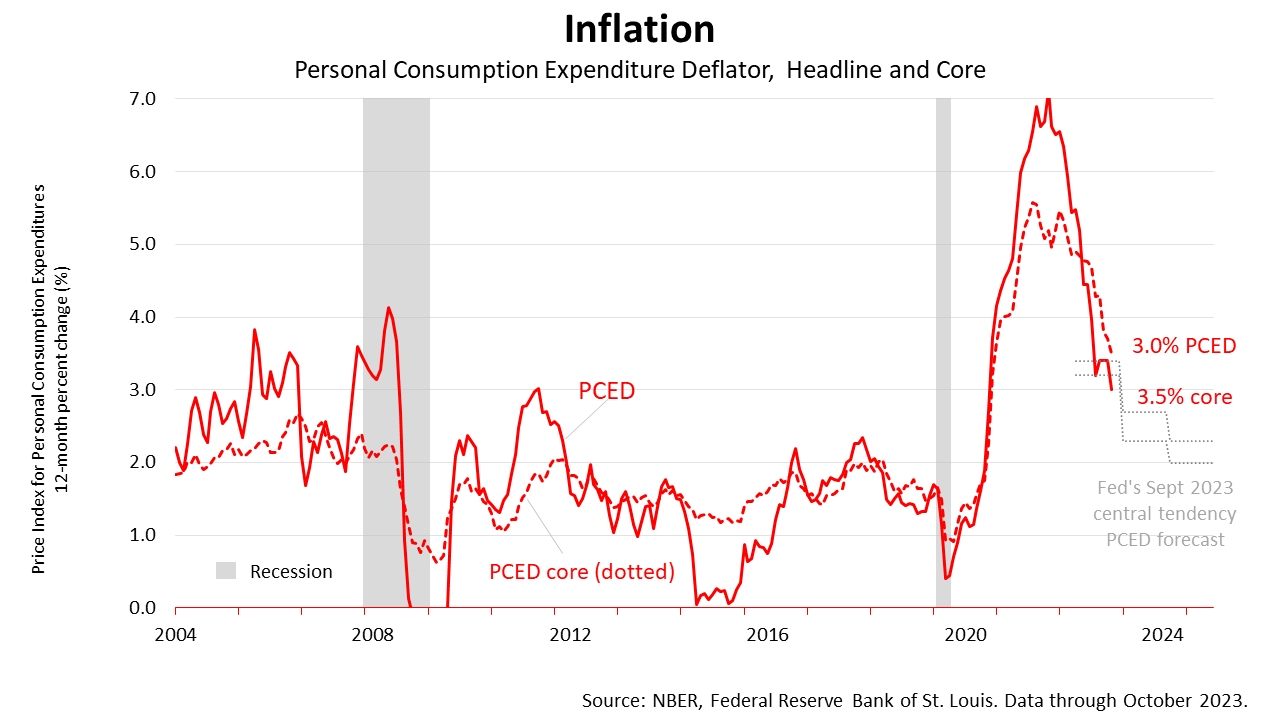

Inflation continued to fall in October and the economy showed signs of cooling down this past week.

The inflation index the Federal Reserve references in its policy statements dropped from 3.4% in the 12 months through September to 3% in the 12 months through October.

Meanwhile, consumer spending rose 0.2% in October, much lower than the 0.7% rise in September, the Commerce Department said Thursday.

In addition, economic activity in the manufacturing sector contracted in November for the 13th consecutive month, according to the Institute of Supply Management. The Manufacturing Purchasing Managers Index registered 46.7% in October, which is 2.3 percentage points lower than the 49 percent recorded in September and indicates a recession is under way in the manufacturing sector accounting for about 10% of U.S. economic growth.

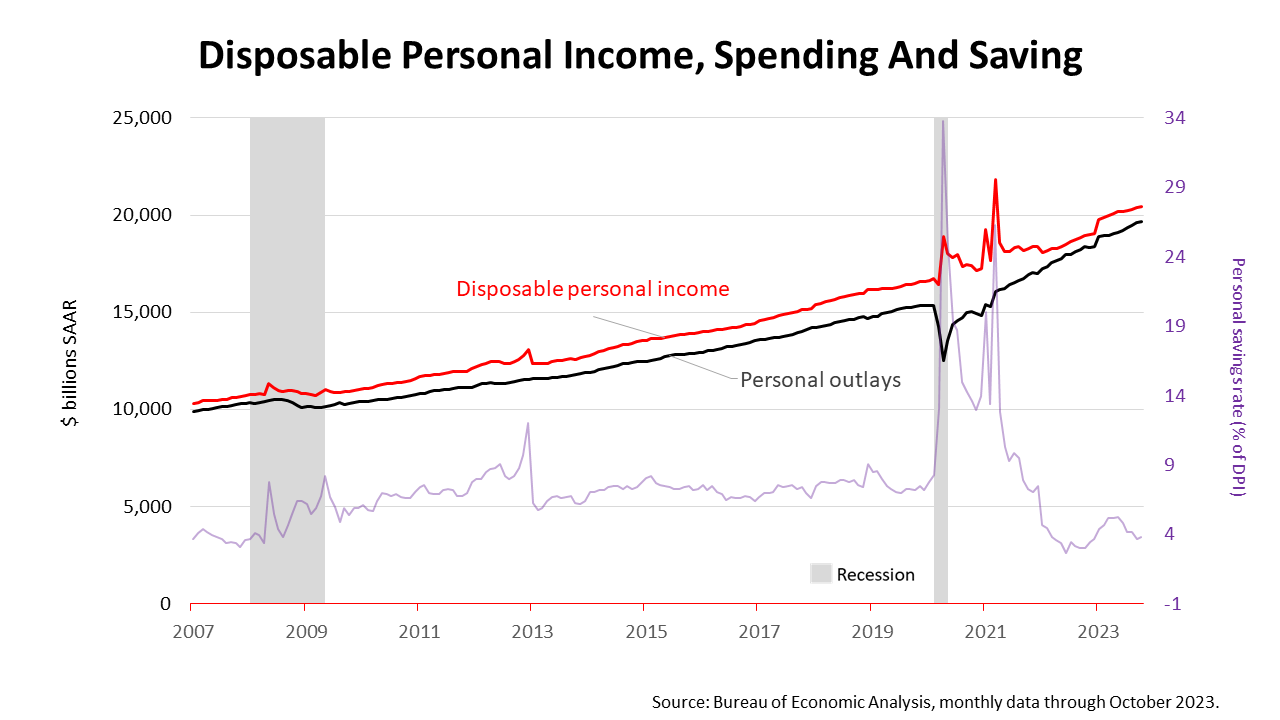

In addition, disposable personal income (DPI), a measure of income after current taxes, increased in October by $63.4 billion, or 0.3%, and personal consumption expenditures increased by $41.2 billion, or 0.2%.

In the 12 months through October DPI rose by 7.8%, while personal outlays rose by 7%. Those are strong income and spending figures, but the rate of increase has slowed.

The savings rate, at 3.8%, is below pre-Covid levels, as it has been since the government stimulus in 2020 and 2021.

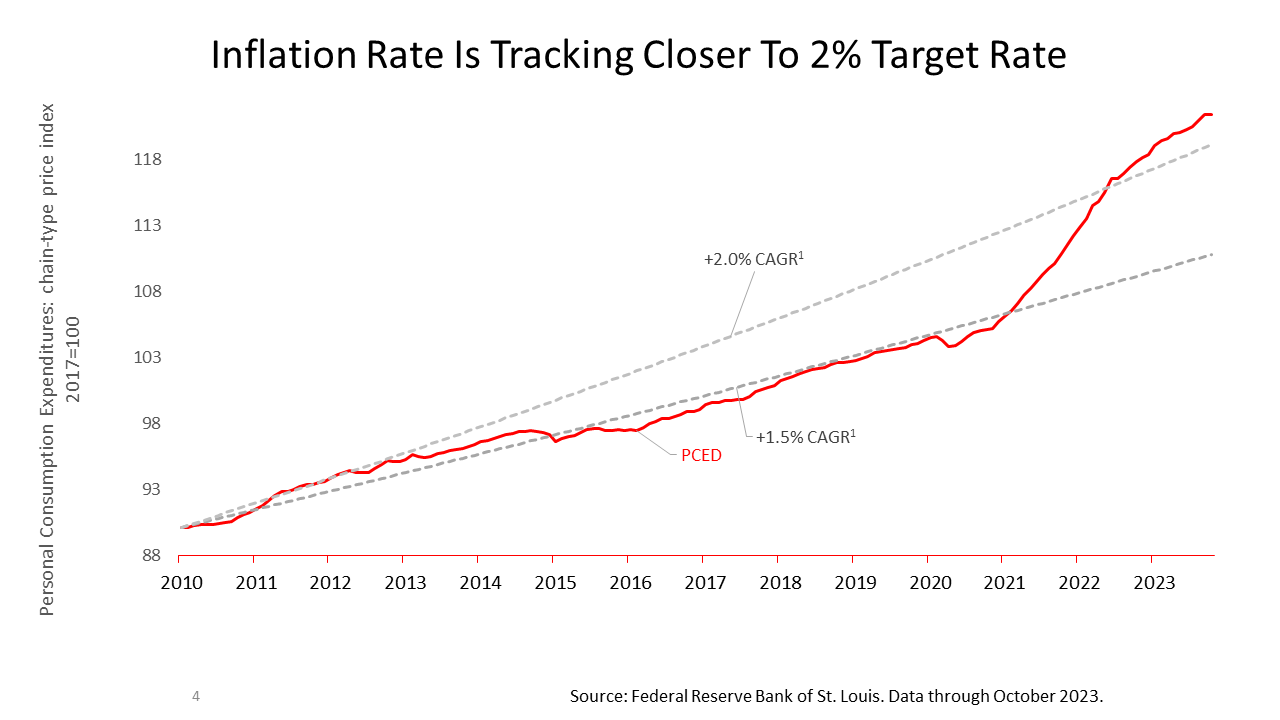

The slope of the 12 month PCE deflator index is reapproaching the 2% trajectory targeted by the Federal Reserve. Inflation is bending back to 2%, following the sharp acceleration experienced after the pandemic.

This shows the Fed’s monetary policy — hiking rates 11 times in the 19 months after March 2022 — has been effective and inflation has come under control. It also indicates no additional rate increases are likely. The next Federal Reserve change to lending rates may not come until the middle of 2024 or later, and it may be a rate decrease.

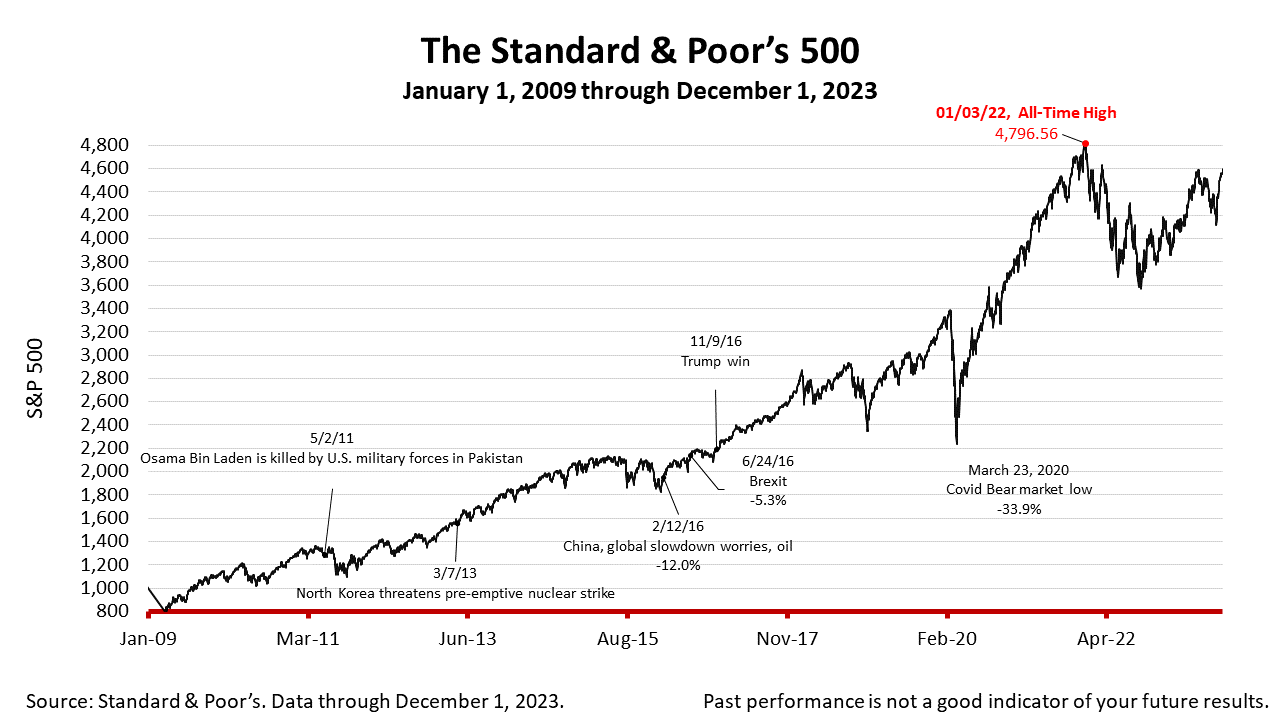

The slowing economy and declining inflation rate buoyed stocks, sending prices higher for the fifth week in a row. The Standard & Poor’s 500 stock index closed Friday at 4594.63, up +0.59% from Thursday, and up + 0.97% from a week ago. The index is up +105.36% from the March 23, 2020 bear market low and is only -4.21% from its January 3, 2022, all-time high.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.