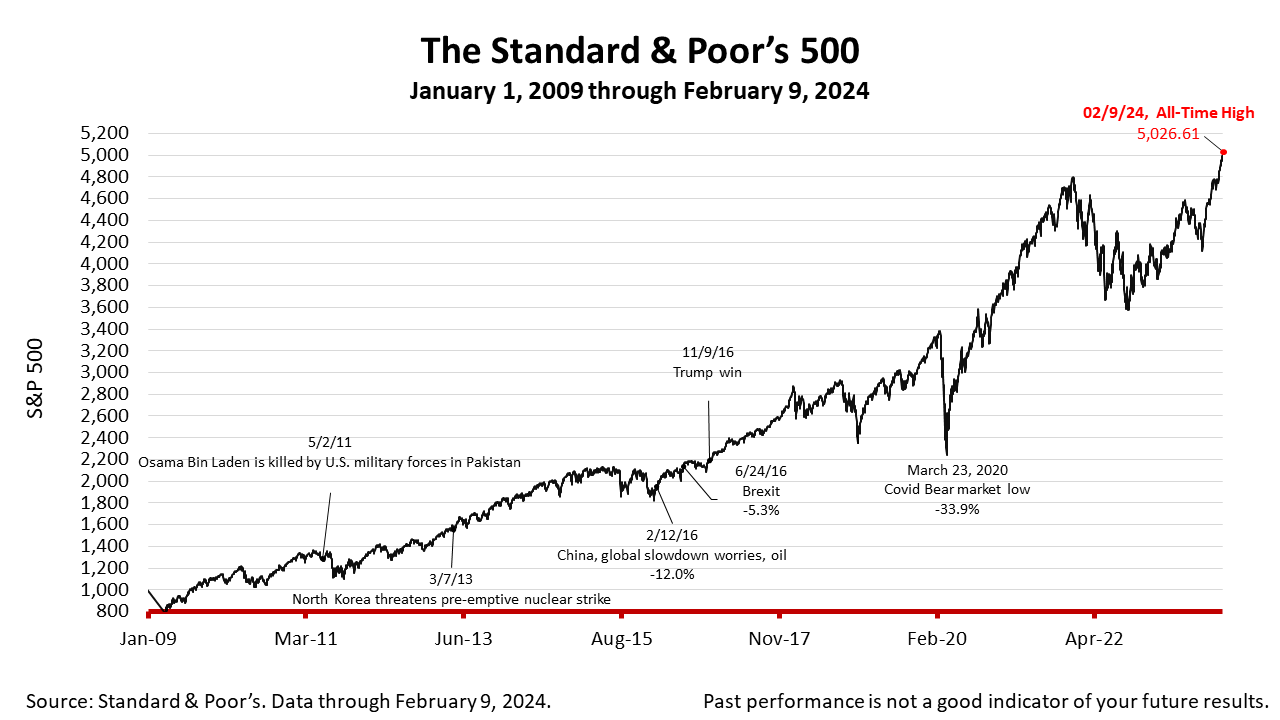

The Standard & Poor’s 500 stock index closed Friday at 5026.61, breaking its all-time and closing above 5000 for the time ever.

Stocks have been repeatedly breaking records since early January, as economic data has continued to beat expectations, extending a trend that began in 2023.

With job creation at a pace accompanying expansion cycles in recent decades, unemployment at a 50-year low, the 12-month inflation rate near the Federal Reserve Board’s 2% target, and wage inflation weakening, the outlook for growth is stronger than expected.

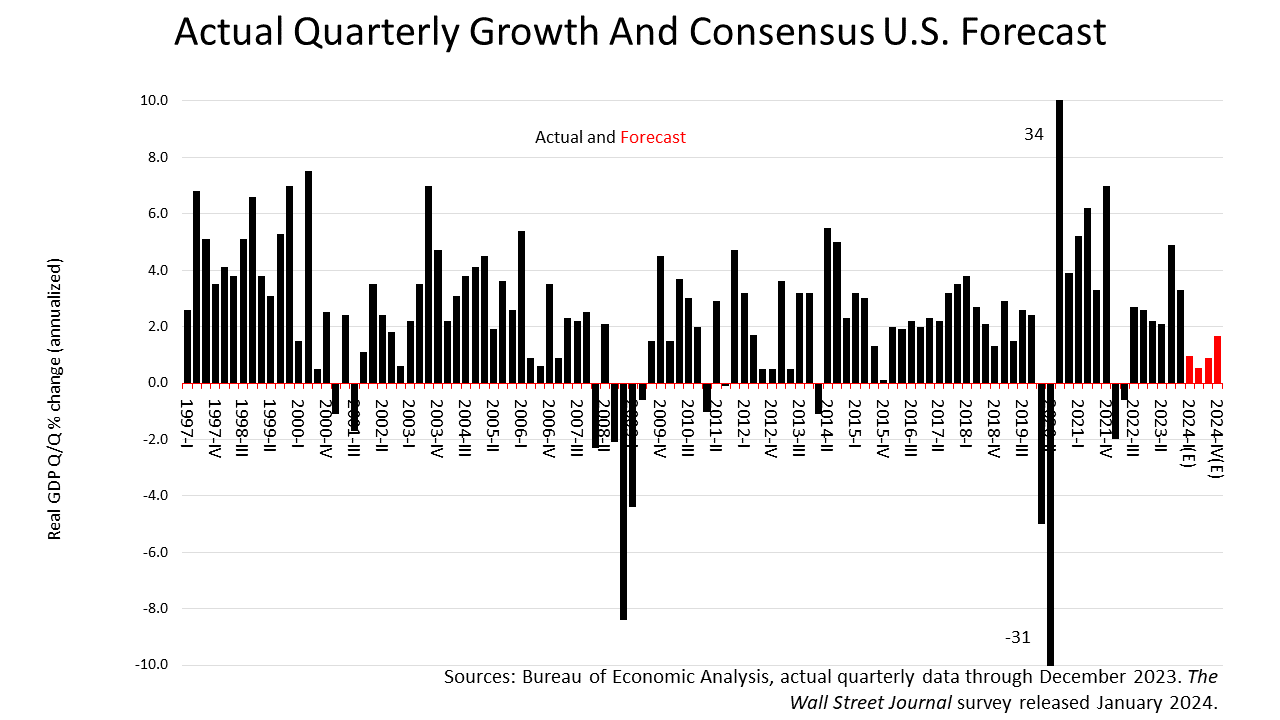

For example, the 60 economists surveyed in early January by the Wall Street Journal predicted a slowdown ahead, but no recession. Compared to the 3.3% U.S. growth rate experienced in the fourth quarter, the WSJ consensus forecast called for 0.94% growth in the first quarter of 2024 and 0.55 in the second quarter.

However, with the release Monday, Feb 5 of the Institute of Supply Management survey of purchasing managers in the service sector of the economy, which accounts for 89% of U.S. growth and 91% of job creation, a sharp slowdown is unlikely. The purchasing managers reported business activities in the service sector shot from 50.5% in December to 53.4% in January. In addition, ISI’s index of new orders coming into the pipeline in the weeks ahead rose to 55%, indicating an increase in activity in February is likely underway.

The Standard & Poor’s 500 stock index closed Friday at 5026.61, up +0.57% from Thursday, and up + 1.37% from a week ago. The index is up +124.66% from the March 23, 2020 bear market low.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market-value weighted index with each stock's weight proportionate to its market value. Index returns do not include fees or expenses. Investing involves risk, including the loss of principal, and past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.